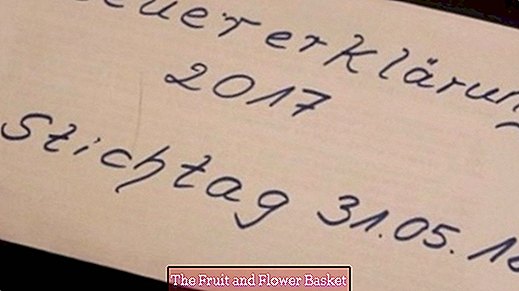

Deadline - Tax declaration 31.05.2018

There is not much time left to file the tax return for the year 2017. The deadline is 31.05.2018. Who makes it easy and has the necessary financial resources, can make the statement from the tax accountant. In my opinion, this is worthwhile only if one can count on a high reimbursement of the taxes paid.

In the course of a year, however, there may well be changes that lead to the income tax return refunds made by the tax office.

If you z. B. marries, a child is born, increase the employment costs by changing jobs. There are some tax-relevant reasons that then speak in favor of a tax return.

If you are not so good in the "tax jungle", there is definitely help in the fight with the forms.

Wage tax assistance associations offer help but are associated with costs and membership. The costs depend on the income. Some income tax assistance organizations still require an additional admission fee and the deadlines for termination are unfortunately not uniformly regulated.

What I have already used several times for this purpose is a tax software that is available from many different providers. The instructions from the CD on my PC, I could easily follow and send the forms in the Elster format to my local tax authority.

I have had very good experiences with it. However, I've researched a bit longer on the net to get the right product. This is definitely worth it, because just because a tax software is more expensive than others, it does not necessarily have more to offer in terms of content.

Those who are taxed for income because of their income will certainly have their own method, but anyone who has had a change that could lead to a reduction in the tax burden would recommend making a statement.

This is in many cases not associated with high costs and who is not happy if he gets once again money from the tax authority?