Mortgage lending, please pay attention to the total effective interest rate

Many consultants in banks are under pressure to sell. The reason is the personal goals of each adviser, which they receive through their superiors. It happens again and again that a home savings or other product must be accommodated. Popular means here is the so-called special loan of building societies to supposedly super-conditions. These conditions are often misleading.

Every day in practice, I have clients who are firmly convinced that they have made a bargain. Interest rates below 3.5 percent to 10 years. Do not you know the advertisement: "1.99% effective interest rate" etc.

My warning to you: beware of bait, do not be fooled. The saving rates for the home savings contract are not included in the so-called initial effective interest rate.

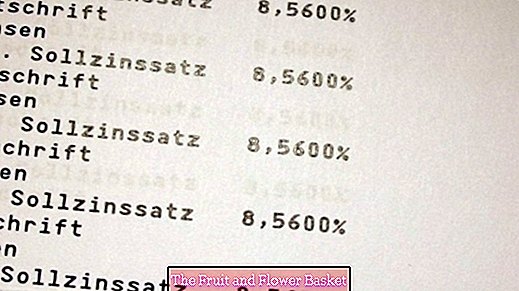

The bottom line is that it's usually expensive. With so-called Bauspar offers / Combi products always let the total effective interest rate including all costs in writing. Well not noticed the effective interest rate but the total effective interest rate and you will be very surprised.

Building savings is basically very useful as advance savings, but not for immediate financing.