Bring insurance and electricity up to date

I've found that actually, by comparing and reviewing existing insurance, unused accounts or credit cards, electricity rates or car insurance policies, you can save a lot when you update everything.

For example, this year I have optimized the following. (The conditions have remained largely the same, and have only "worsened" if I have decided to do so.) For example, I did not insure bicycle theft because my bike is either in the closed basement or I am driving it.)

Household goods, liability and legal protection

old 334 euros a year

new 192 euros per year

Savings 142 Euro per year due to provider change

Car insurance

old 300 euros a year

new 264 euros per year

Savings 36 euros per year Adjustment of the km-performance

Telephone and internet

old 29.90 euros per year

new 25,00 Euro per year

Savings 4.90 euros per month and 3 months free by provider change

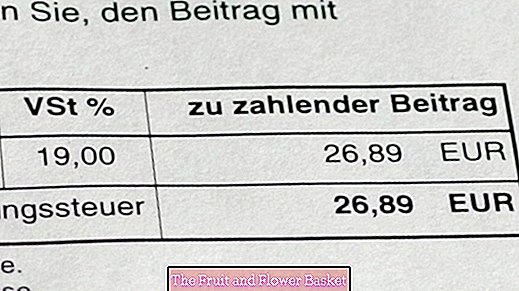

electricity

old 660 euros per year

new 380 euros per year

Savings 280 euros per year through new customer bonus and tariff matching my kW / h consumption

Digital TV

old 4,45 Euro mtl.

new 0,00 Euro mtl.

Savings 4,45 Euro mtl. through abolition because I've watched the Italian channels that I've received far too rarely

Fitness center

old 16,90 Euro mtl.

new 0,00 Euro mtl.

Saving 16,90 Euro mtl. by termination of my contract, because currently at work often on the road and irregular working hours

Credit card

old 20 euros a year

new 0,00 Euro per year

Saving 20,00 Euro per year by canceling the card through my bank and applying for a free credit card

Overall, this makes me in the year 912.00 euros and thus 76.50 euros mtl. That's a really good trip in the European area ...

It really pays off and changing is really a breeze.